Blog

Insights on home equity, alternative finance and Canadian real estate.

Beyond the Bank of Mom and Dad: How to Gift a Down Payment, Protect Your Retirement, and Build Family Wealth

This blog post is provided for informational purposes only and is not financial advice regarding any product. You should consult a certified financial planning professional, such as a Certified Financial Planner or a Qualified Associate Financial Planner, if you are looking for advice regarding financial products. The “Bank of Mom and Dad” has become one…

Your Home Equity: A Guide to Calculating, Building, and Accessing It

Home equity has become a significant asset for many Canadians. Our analysis has found that home equity represents between half and two-thirds of the median homeowner’s net worth in Canada. But unlike traditional financial assets like stocks and bonds, your home equity doesn’t appear in an account or on a bank statement. Even though you…

Hello, Financial Post and Apple News+ readers! 👋

The conversation about Home Equity Sharing Agreements (HESAs) has taken a major step forward in Canada, sparked by a recent feature in the Financial Post and its inclusion in the Best of Apple News+. As the first Canadian company to launch a HESA back in early 2024, we’re excited to see this innovative option reach…

A Lifeline for Homeowners Struggling with High-Interest Debt

Owning a home in Canada is a major achievement. But what happens when the cost of everything else, from groceries to credit card interest, starts to overshadow that success? For millions of homeowners, rising interest rates and stubborn inflation are creating a financial squeeze that’s impossible to ignore, driving up consumer debts and straining monthly…

Missed the Greener Homes Loan? Tap into Your Home Equity to Fund Green Upgrades

As of October 2, 2025, the Canada Greener Homes Loan is no longer accepting applications for its $40,000 interest-free loans that have helped over 120,000 Canadian households make their homes more energy-efficient. This closure follows that of the companion Canada Greener Homes Grant in early 2024, which has provided grants up to $5,000 to 400,000…

Understanding Fair Market Value Appraisals

What is an FMV appraisal? A fair market value (FMV) appraisal in an unbiased estimate of what a property would sell for in an open and competitive market. An FMV appraisal takes in factors like location, condition and recent comparable sales into consideration when determining the property’s value. This type of appraisal aims to reflect…

HESA vs Reverse Mortgage: A Cost Comparison for Canadian Homeowners

This blog post is provided for informational purposes only and is not financial advice regarding any product. You should consult a certified financial planning professional, such as a Certified Financial Planner or a Qualified Associate Financial Planner, if you are looking for advice regarding financial products. “How does a Home Equity Sharing Agreement (HESA) compare…

Your Home’s Capital Stack: The Key to Financial Flexibility

You’ve worked hard for years and your home is likely your most significant asset. It represents dedication, memories and a cornerstone of your financial life. But is that hard-earned equity working as effectively for you as it could be, especially when day-to-day cash flow feels tighter than you’d like? For decades, homeowners have seen their…

The Great Divide in the GTA Housing Market

The spring housing market in the Greater Toronto Area (GTA) hasn’t just been a bit sluggish, it’s split in two. As highlighted in the Canada Mortgage and Housing Corporation’s (CMHC’s) recent Housing Market Outlook, residential real estate in the GTA isn’t moving as a single market anymore. Instead, we’re seeing a clear divergence, with condominiums…

Beyond Interest Rates: Hidden Mortgage Loan Features and Their Impact on You

You know about fixed versus variable interest rates but what about the rest of the terms of your mortgage loan? These often-overlooked details can help or hinder your financial flexibility, especially when considering options for secondary financing, like a Home Equity Sharing Agreement (“HESA”, rhymes with ‘visa’) from Clay Financial. While we’re not a mortgage…

From Extra Space to Extra Cash: The GTA Homeowner's Intro to Basement Suites

A basement suite allows homeowners to transform an under-used space into a valuable asset. Not only can it generate rental income or provide expanded living arrangements for multi-generational families, but it also increases your home’s value and marketability. A finished basement suite makes the home more appealing to future buyers, setting it apart from other…

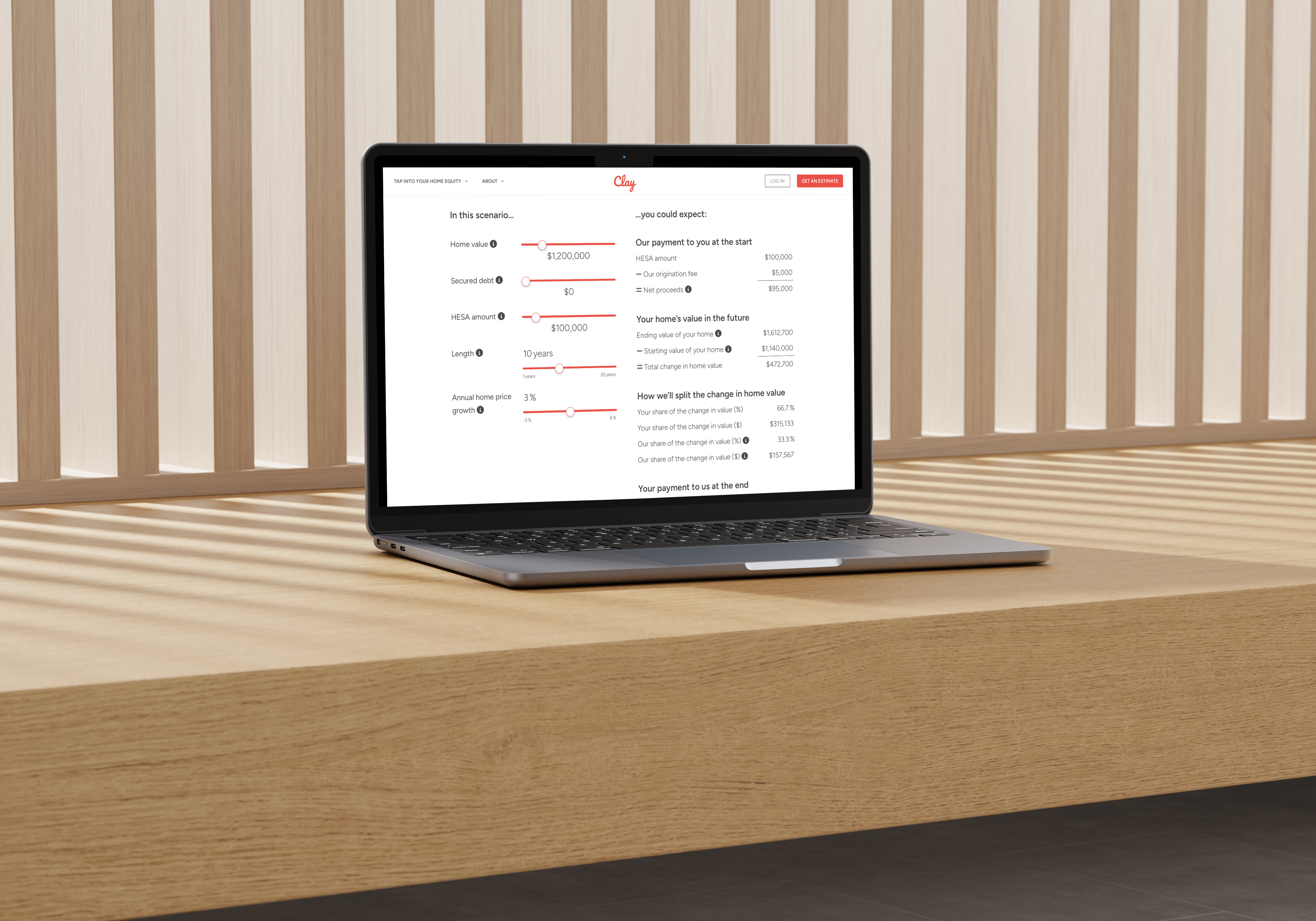

Clay Financial launches HESA Calculator

We’ve launched a new tool to help homeowners learn about our Home Equity Sharing Agreement (HESA). Our HESA Calculator lets you see how much equity you can access in cash today and what your payment could be at the end of your HESA. Clay is not a lender and a HESA is not debt. Instead,…

7 Ways To Access Your Home Equity in Canada

Whether you want to retire comfortably, renovate your home, consolidate debt, start a business, help your kids with a down payment on their first home or diversify your investments, the equity in your home could be the key to making your financial goals a reality. Canadian homeowners have built up a staggering amount of home…

Clay Financial's HESA now live in the GTA

Applications are now open for our Home Equity Sharing Agreement (”HESA” – rhymes with visa) in the Greater Toronto Area! From Toronto to Newmarket and Burlington to Oshawa, homeowners now have a smarter alternative for tapping into their home equity. Home equity has become a substantial portion of Canadian homeowners’ wealth (over $5 trillion!). Until now, there…

Clay Financial Inc. Raises $1.7 Million to Revolutionize Home Equity Access for Canadian Homeowners

Toronto-based fintech Clay Financial Inc. (“Clay”) has successfully closed its pre-seed funding round, securing $1.7 million. Clay is building innovative solutions to help Canadians tap into their home equity without selling or taking on debt. The funding will enable Clay to complete development of its novel product and platform, expand its team and fuel the company’s strategic growth…