Your Home’s Capital Stack: The Key to Financial Flexibility

You’ve worked hard for years and your home is likely your most significant asset. It represents dedication, memories and a cornerstone of your financial life. But is that hard-earned equity working as effectively for you as it could be, especially when day-to-day cash flow feels tighter than you’d like? For decades, homeowners have seen their home’s value in two parts: the illiquid equity they own and the mortgage debt they owe. This created a rigid structure where your equity felt trapped unless you were willing to take on more debt or sell your home entirely.

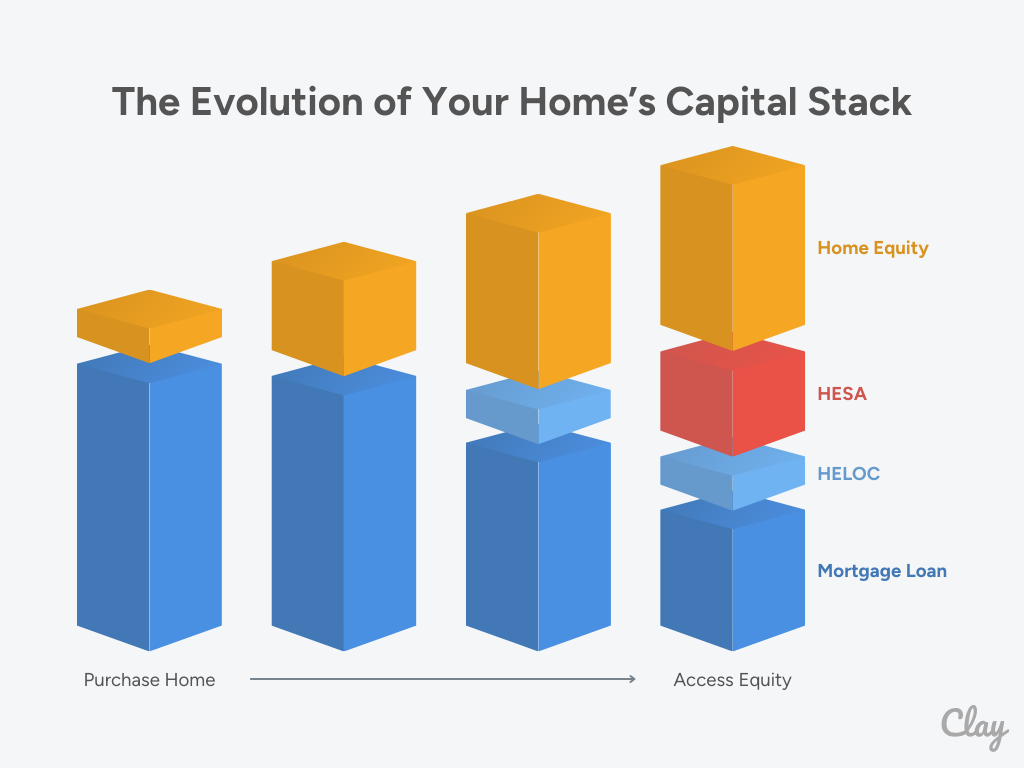

Many Canadian homeowners find themselves in this exact situation. The traditional view presents a false dichotomy: either take on more debt or sell your home to access your equity. We believe there is a better way. Imagine your home’s value not just as debt versus equity, but as a stack of building blocks that can grow, shrink and be rearranged over time. At Clay Financial, we call this your home’s capital stack.

This isn’t just jargon: it’s an intuitive way to see all the components financing your home and to unlock new possibilities. The stack includes your mortgage, but it also makes room for innovative, non-debt solutions. A Home Equity Sharing Agreement (HESA), for example, adds a new block to the stack, allowing you to access a lump sum of cash in exchange for sharing a portion of your home’s future value, without taking on new interest-bearing debt or making new monthly payments. This modern view reveals a much wider range of possibilities, giving you more options and greater control over this vital asset.

How the “Stack” Gives You More Financial Options and Control

Viewing your home’s financing as a stack reveals options you might not have realized you had. It empowers you to take a “choose your own adventure” approach to managing this key aspect of your finances, which is particularly crucial when planning for, or living in, retirement. When income streams might be fixed or less predictable, understanding how to adjust the blocks that make up your home’s capital stack can make all the difference. Understanding your stack is the vital first step towards gaining more control and achieving a greater sense of financial well-being.

Aligning Your Finances with Your Life Goals

Managing your capital stack effectively means more than just tracking numbers; it’s about aligning this part of your financial picture with your life goals. Whether you dream of a comfortable retirement, wish to help family, pursue passions, or simply desire a stronger financial cushion, understanding and adjusting your stack is key, especially when income streams might become fixed.

While your overall financial health includes savings, investments and other assets, the capital stack concept focuses specifically on the financial structure of your home. The main types of blocks are:

- Your Home’s Debt Blocks: This includes any mortgages (first, second, reverse, etc.) and home equity lines of credit (HELOCs) secured against your home.

- Your Home Equity Block: This is the portion of your home’s value that you own outright.

- Your Home’s Innovative Blocks: This is where new and innovative non-debt solutions fit into your home’s capital stack. For example, a HESA from Clay Financial that allows you to convert illiquid equity into cash or a shared ownership agreement from a different provider that provided assistance for your original down payment.

Understanding the tools available to adjust this stack, especially innovative tools that don’t necessarily add to your monthly debt burden, allows you to make changes for maximum benefit.

Understanding Your Home’s Capital Stack Today

Every homeowner’s situation is unique. Let’s take a moment to understand the current chapter of your home’s capital stack. This isn’t about judgment, but about clear-eyed understanding – a crucial step towards empowerment.

Getting to Know the Blocks of Your Home’s Capital Stack

- Your Home’s Debt Blocks: For any mortgage loans, what is the outstanding balance? What is the interest rate and term? How do the payments fit into your monthly budget? If you have a HELOC, what is its balance and limit? What are the repayment terms and interest rate? How are you using it and how do its payments affect your cash flow?

- Your Home’s Equity Block: This is the current market value of your home minus any outstanding mortgage(s) and HELOC balances. It represents the wealth you’ve built in your property. Right now, a large portion of this might feel “trapped“ – significant on paper, but not easily usable for everyday needs or new opportunities. We’ll explore how to change that.

- Your Home’s Innovation Blocks: These tend to be financial contracts backed by the value of your home. There has been significant innovation in this space over recent years as homes became increasingly valuable and a larger share of each homeowner’s net worth. Most Canadian homeowners do not currently use any of these solutions, like HESAs and down payment assistance solutions. So your home’s capital stack may not have any blocks in this category yet!

(While other financial elements like your savings, investments (RRSPs, TFSAs), credit card debts and car loans are vital to your overall financial picture, for the purpose of understanding your home’s capital stack, we’re focusing on these three core layers related directly to your home’s financing.)

Is Your Home’s Capital Stack Balanced for Your Current Life?

Once you understand the blocks of your home’s capital stack today, step back. How do the proportions feel to you? Does your home’s current financial structure feel balanced and supportive of your lifestyle, or does it create pressure or limit your options? Ask yourself these key questions to see if your home’s capital stack fit your life stage (especially nearing or in retirement):

- Considering my current life stage, does my current mix of mortgage debt versus home equity still serve me best? What felt right a decade or two ago might need rethinking for today’s needs.

- If I’ve had a Home Equity Line of Credit (HELOC) for many years, does it still align with my current cash flow realities and my goals for this next phase of life? Are the monthly payments comfortable, or are they becoming a source of strain?

- How does my home’s current financing impact my flexibility? Does it give me options and a sense of security when facing unexpected events or considering new opportunities, or does it feel restrictive?

- Are there ways I could adjust my home’s financial structure to better support my aspirations now? Could I, for instance, reduce monthly payment pressures or unlock funds for important personal or family goals without taking on unmanageable new burdens?

- Ultimately, does my home’s current financing bring me peace of mind, or does it create underlying stress, particularly concerning my monthly cash flow?

Answering these questions honestly can illuminate areas where your home’s current financial structure might be working against you and where changes could bring significant benefits. If you’ve realized your capital stack feels unbalanced, the next question is ’What can I do about it?’ You now know you have options beyond taking on more debt or selling your home.

Clay Financial’s HESA: A Modern, Flexible Way to Access Your Equity

So, what exactly is a HESA? The Clay Financial HESA is an innovative financial tool that allows homeowners to access a portion of their home equity – the wealth built up in their home – without taking on new monthly loan payments. Think of it as adding a new, flexible, and accessible block to your home’s capital stack.

- No New Required Monthly Payments: This is a significant advantage for many homeowners, particularly those on a fixed income or anyone looking to improve their monthly cash flow. You can unlock funds you need without adding the burden of another regular payment to your budget.

- Maintains Homeownership: With a HESA, you continue to own your home. You live in it, maintain it, and you continue to benefit from its potential future appreciation on the portion of the home you still fully own, while sharing in the appreciation on the portion Clay has invested in.

- Flexible Use of Funds & Timeline: The funds accessed through a HESA can be used for a wide variety of purposes – those “whys” we discussed earlier. With a term of up to 25 years and the flexibility to sell at any time, the HESA also offers potential for long-term financial planning and stability.

Unlock More Equity Without Disrupting Your Existing Mortgage

One of the most powerful advantages of a Clay Financial HESA is its ability to integrate with your current financial structure. While many equity access products require you to refinance or pay off your existing mortgage and HELOC, a HESA can often work alongside them. This means you don’t have to sacrifice financial arrangements that are already serving you well. Here’s how that flexibility could work in practice:

A Key Advantage: Keep your low-interest mortgage while also accessing your equity

Imagine a homeowner entering retirement. They have a mortgage and a HELOC with a combined balance of $200,000. Thanks to refinancing years ago, their mortgage has a 3% interest rate and their HELOC is manageable at 5%, making their payments comfortable on a fixed income.

They need to access an additional $100,000 from their home’s equity to fund their goals. An option like a reverse mortgage would require them to consolidate all their debt. This would mean replacing their low-interest loans and borrowing the full $300,000 at a new and much higher interest rate.

With a HESA, they can avoid that costly overhaul. They can keep their $200,000 of low-cost debt exactly as it is and simply add the HESA to access the additional $100,000 that they were looking for. This approach allows them to tap into more of their equity while preserving the favourable terms they worked hard to secure, offering a better way to fine-tune their finances.

That flexibility can have a major impact on a homeowner’s net worth over time. For those who want to dig into the numbers, we explore this concept with a quantitative cost comparison of HESAs and reverse mortgages in various scenarios in a companion blog post.

Is a HESA Right for You?

Understanding your home’s capital stack is the first step. The next is seeing how you can reshape it to meet your goals. Get a free, no-obligation estimate from Clay Financial to see how much equity you may be able to access with a HESA.