HESA vs Reverse Mortgage: A Cost Comparison for Canadian Homeowners

This blog post is provided for informational purposes only and is not financial advice regarding any product. You should consult a certified financial planning professional, such as a Certified Financial Planner or a Qualified Associate Financial Planner, if you are looking for advice regarding financial products.

“How does a Home Equity Sharing Agreement (HESA) compare to a reverse mortgage?” It’s a question we hear all the time at Clay Financial, and for good reason. With Canadian home values having grown substantially over the years, many long-time homeowners are looking for smart ways to access their equity. Both HESAs and reverse mortgages are powerful tools for this, but they work in fundamentally different ways.

The short answer to the cost question is: it depends. The cost of a reverse mortgage is tied to an interest rate that changes over time, while the cost of a HESA is linked to your home’s future appreciation. Since no one has a crystal ball, any direct comparison requires making some informed assumptions about the future.

But we can explore common scenarios to see how they stack up. This article will walk you through a few quantitative examples to help you understand the trade-offs and make a more informed decision for your financial future.

Here are three key takeaways to keep in mind:

- Flexibility and time are your friends. A HESA is best viewed as a long-term, flexible financing option. Its cost-competitiveness with a reverse mortgage often improves significantly the longer you have it.

- Your existing equity is protected. Unlike a reverse mortgage where compounding interest can erode your home equity—sometimes significantly—a HESA shares in the future appreciation of your home. This provides invaluable peace of mind, especially for homeowners who plan for their home to be a key part of the legacy they leave for their loved ones.

- HESAs play well with debt products. A HESA’s ability to be added behind an existing mortgage or HELOC is one of its greatest strengths. It allows you to fine-tune your home’s capital stack precisely, rather than taking the all-or-nothing path required by a reverse mortgage.

Methodology and Key Assumptions

Before we dive into the numbers, it’s important to state that any cost comparison is driven by assumptions. It’s impossible to predict with certainty how variables like home prices and interest rates will move in the future. Our goal here is to provide a framework for thinking about the costs, not to predict a single definitive outcome.

For our scenarios, the key variables are:

- Term Length: How long you keep the financing in place.

- Home Price Appreciation: The average annual growth rate of your home’s value.

- Existing Secured Debt: The amount and interest rates of any current mortgages or HELOCs.

- Reverse Mortgage Interest Rate: The expected long-term average interest rate on a reverse mortgage.

We’ll look at a homeowner seeking to access $100,000 from their home. For simplicity, we’ve ignored any associated fees and rounded figures to the nearest thousand dollars. We’ve also assumed that any cash saved from not making mortgage payments (in the reverse mortgage scenario) is invested in a savings account earning 1.75% per year.

A quick note on terminology: a HESA doesn’t have an interest rate. Its “cost of capital” is the effective annualized rate of return that Clay Financial earns on its investment based on its share of the home’s appreciation over the term. Think of it as the implied cost you pay for accessing the equity. For the homeowner’s “net worth,” we are referring only to the value of their home equity plus any cash generated from the financing options discussed.

A Head-to-Head Comparison: No Existing Debt

Let’s start with a simple case: a homeowner with no existing mortgage or other debt wants to access $100,000. They are considering either a HESA or a reverse mortgage.

Assume they keep the solution for 25 years and their home appreciates at an average of 5% per year. In this scenario, the HESA’s annualized cost of capital is 10.0%. If the long-term interest rate on a reverse mortgage is 10.0% (which becomes an effective annual rate of 10.3% due to semi-annual compounding), the HESA is slightly cheaper. That small difference, magnified by the power of compounding over two and a half decades, leaves the homeowner with an extra $72,000 in net worth. If long-term reverse mortgage rates were higher, say 11-12%, the relentless nature of compound interest would make the HESA significantly more advantageous, leaving the homeowner better off by $380,000 to $767,000.

However, the term length is crucial. Over a shorter 10-year period (with the same 5% appreciation and 10% interest rate), the reverse mortgage would actually provide $106,000 more value to the homeowner. Why? Because the shared appreciation in the HESA is realized more quickly, while the reverse mortgage’s interest has had less time to compound.

This simple comparison is useful, but it isn’t the reality for most homeowners we work with. The vast majority have some form of existing secured debt, which brings us to our next, more realistic scenario.

The Real-World Advantage: Combining a HESA with Existing Debt

This is where a HESA’s flexibility really shines. Let’s consider a homeowner who wants to access $100,000 but currently has a $50,000 mortgage at a 5% interest rate and a $50,000 HELOC at a 6% interest rate.

A reverse mortgage requires that all existing secured debt be paid off and consolidated into the new reverse mortgage. So, the choice isn’t between a $100,000 HESA and a $100,000 reverse mortgage. The choice is between:

- Adding a $100,000 HESA behind their existing mortgage and HELOC; and

- Replacing their entire $100,000 of existing debt with a new $200,000 reverse mortgage (to pay off the old debt and get the desired $100,000 cash).

Let’s assume the home appreciates at 5% annually and the reverse mortgage rate is 10% (10.3% effective annual rate). Over 20 years, the combined annualized cost of capital for the HESA, mortgage, and HELOC is 8.2%. This “blended” cost benefits from the lower rates on the existing mortgage and HELOC, making it 2.1% lower than the reverse mortgage’s standalone rate.

This difference in cost of capital translates to over $422,000 more in the homeowner’s pocket after 20 years by choosing to add a HESA rather than replacing everything. That’s a life-changing amount of money that could mean a more comfortable retirement, significant gifts to family, or simply greater financial security.

The benefit of the HESA combination still holds, but is less pronounced, over a shorter 10-year period, where its annualized cost of capital is 0.5% less than that of the reverse mortgage. This again shows how treating a HESA as a longer-term solution can unlock more value.

How Do Changing Assumptions Affect the Outcome?

The real world is complex, so let’s look at how the outcome changes when we adjust our assumptions, using the 20-year term from our original example above (8.2% cost of capital and a $422,000 boost to the homeowner’s net worth):

- Higher Reverse Mortgage Rates: If rates average 11%, the HESA combination becomes 3.1% cheaper annually, boosting the homeowner’s net worth by a staggering $717,000.

- Lower Reverse Mortgage Rates: If the long-term reverse mortgage rate drops to 9%, the HESA combination is still 1.0% cheaper per year, resulting in a $177,000 net benefit. At 8%, the costs are nearly identical, with the reverse mortgage being slightly better by $26,000.

- Higher Home Appreciation: Since the HESA’s cost is tied to appreciation, a booming housing market makes it more expensive. If home prices grow at 6% annually (with a 10% reverse mortgage interest rate), the HESA combination is still beneficial to the homeowner’s net worth but to a lesser degree (a $201,000 boost instead of $422,000). The length of the HESA is important here. For example, at 6% home price appreciation and a 10% interest rate on the reverse mortgage, the HESA combination is more expensive than the reverse mortgage after 10 years, slightly less expensive than the reverse mortgage after 15 years and, by year 25, the homeowner is ahead by $622,000. This powerfully demonstrates the strategic value of a longer HESA term. It provides the crucial flexibility to not only navigate changing market conditions but also to capitalize on the agreement’s structure, which often becomes more financially advantageous the longer it’s held. A 10-year maximum term could force an exit when the cost is highest, denying the homeowner the flexibility to wait for the financial picture to improve.

- Lower Home Appreciation: If home prices appreciate at only 4% each year for the 20 years in this example instead of 5%, the homeowner’s net worth is $607,000 higher compared to the reverse mortgage scenario.

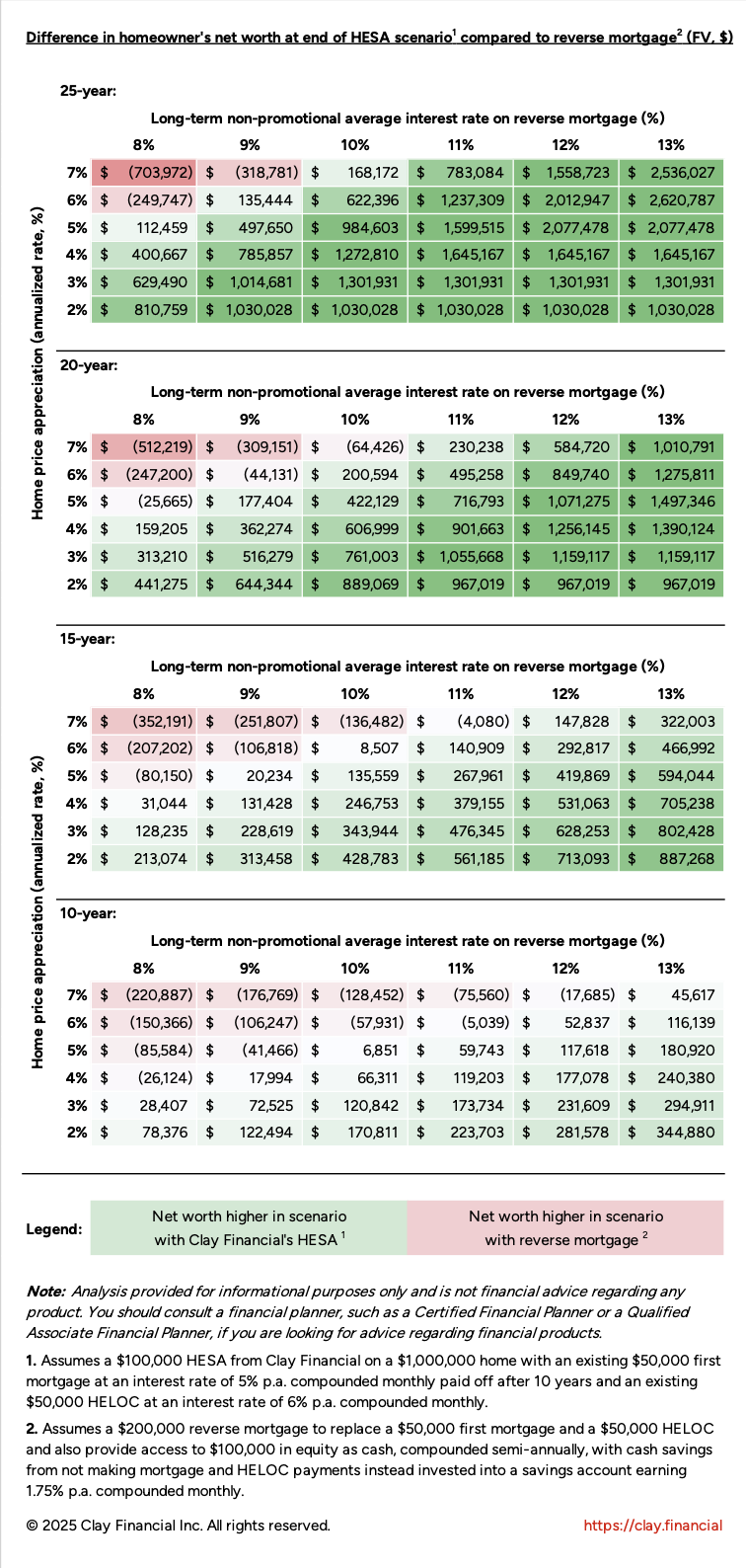

To visualize the interplay between these variables, we’ve prepared a sensitivity analysis:

The trend is intuitive: higher interest rates make reverse mortgages more expensive, and higher appreciation makes HESAs more expensive. What’s interesting is the relationship between them. At a 25-year term, home appreciation can be less than 3 percentage points below the reverse mortgage interest rate, and the HESA scenario still comes out ahead. For a 10-year term, that gap needs to be around 5 percentage points. This once again underscores the value of flexibility and a long-term horizon.

Beyond the Numbers: The Unquantifiable Benefits of a HESA

The financial analysis is compelling, but for many homeowners, the biggest benefits aren’t just about the final dollar amount. It’s the “lightbulb moment” when they realize a HESA can’t touch their existing equity.

They’ve worked their entire lives to build that value, and many have earmarked it for their children or other loved ones. The fact that a HESA only shares in future growth protects their nest egg from the downside risk of compounding interest. It removes the anxiety of watching a loan balance grow and grow, potentially consuming the entirety of their home’s value in a worst-case scenario. This protection of their legacy is often the most important factor.

What If You Don’t Qualify for a Reverse Mortgage?

There’s also a significant group of homeowners who can’t get a reverse mortgage. They might be too young (under 55) or their property may not qualify. These individuals, who often have existing mortgages in our experience, might be entrepreneurs looking for start-up capital or young families wanting to do major renovations. Their alternative for accessing significant funds might be secured personal loans or other secured debt products with interest rates in the high teens or even 20%+! In these cases, the financial argument for a HESA becomes overwhelmingly compelling, offering a much more affordable and sensible way to access their equity.

Conclusion

So, how does a HESA compare to a reverse mortgage? While every situation is unique, our analysis shows that for many Canadian homeowners, particularly those with existing debt, a HESA can be a more flexible and cost-effective solution over the long term.

By working with your existing financing and protecting the equity you already own, a HESA allows you to access your home’s wealth without the risks of compounding interest. The key is to view it as a long-term partnership that gives you options and control over your most valuable asset.

Ready to see what a HESA could look like for you? Use our free, no-obligation HESA Calculator to run your own scenarios or get an estimate in minutes to find out how much equity you could access with a HESA from Clay Financial.