Our mission

Why we started Clay Financial and created Canada’s first Home Equity Sharing Agreement, or HESA.

To drive innovation at the intersection of finance, technology and real estate to build a new generation of alternative financial solutions that put homeowners first.

Meet our co-founders

Our leadership team combines experience in technology and financial business strategy with deep expertise in financial product innovation. We’re passionate about using financial and technological innovation to provide smarter solutions for Canadian homeowners.

Johnny Henderson

CO-FOUNDER & CHIEF EXECUTIVE OFFICER

Johnny is passionate about building solutions at the intersection of finance and technology. He believes Canadians deserve access to innovative financial products that are more flexible, easier to use and reduce reliance on debt.

Prior to founding Clay Financial, Johnny was a Project Leader at Boston Consulting Group, where he advised leading tech companies, telcos and financial institutions on business strategy. He was previously a corporate and securities lawyer.

Phil Henderson

CO-FOUNDER, CHAIRMAN & CHIEF LEGAL OFFICER

Phil is a leading expert on structured financial products, derivatives and structured finance. He has developed many innovative financial products over his career and co-authored the leading text The Law of Financial Derivatives in Canada.

Over his 35+ career as a Partner at Stikeman Elliott LLP prior to founding Clay Financial, Phil was recognized as one of The Best Lawyers in Canada (Best Lawyers) and one of the Leading 500 Lawyers in Canada (Lexpert).

More than a financial product

We believe in harnessing the scalability of business to do good by doing well. HESAs deliver benefits that improve financial stability across Canadian society.

Reduce household debt

By providing Canadian homeowners with an option other than debt, HESAs can deleverage homes and reduce exposure to shifting interest rates.

Close the retirement gap

HESAs can help Canadian homeowners supplement their retirement income by providing liquidity when it’s needed most.

Improve home affordability

When interest rates rise, property taxes jump or other unexpected costs appear, HESAs can be a lifeline to help homeowners stay in their homes.

Our team

We are a multi-disciplinary team pioneering alternative financial solutions in Canada.

Johnny Henderson

CO-FOUNDER & CHIEF EXECUTIVE OFFICER

Phil Henderson

CO-FOUNDER, CHAIRMAN & CHIEF LEGAL OFFICER

Jake Gamoyda

GROWTH ASSOCIATE

Latest news from Clay Financial

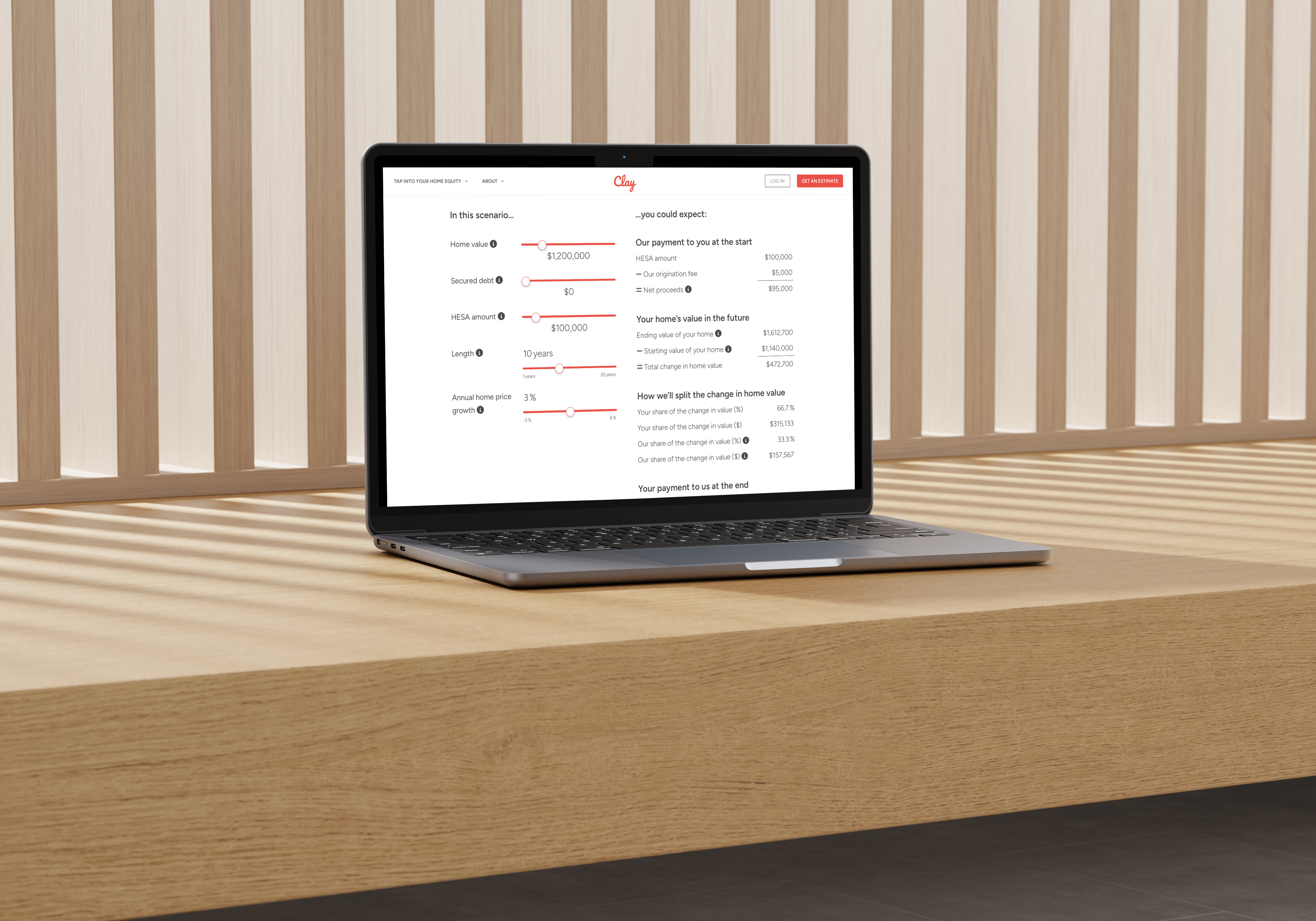

Clay Financial launches HESA Calculator

We’ve launched a new tool to help homeowners learn about our Home Equity Sharing Agreement (HESA). Our HESA Calculator lets you see how much equity you can access in cash today and what your payment could be at the end of your HESA. Clay is not a lender and a HESA is not debt. Instead,…

Clay Financial's HESA now live in the GTA

Applications are now open for our Home Equity Sharing Agreement (”HESA” – rhymes with visa) in the Greater Toronto Area! From Toronto to Newmarket and Burlington to Oshawa, homeowners now have a smarter alternative for tapping into their home equity. Home equity has become a substantial portion of Canadian homeowners’ wealth (over $5 trillion!). Until now, there…

Clay Financial Inc. Raises $1.7 Million to Revolutionize Home Equity Access for Canadian Homeowners

Toronto-based fintech Clay Financial Inc. (“Clay”) has successfully closed its pre-seed funding round, securing $1.7 million. Clay is building innovative solutions to help Canadians tap into their home equity without selling or taking on debt. The funding will enable Clay to complete development of its novel product and platform, expand its team and fuel the company’s strategic growth…