Clay Financial’s HESA now live in the GTA

Applications are now open for our Home Equity Sharing Agreement (”HESA” – rhymes with visa) in the Greater Toronto Area! From Toronto to Newmarket and Burlington to Oshawa, homeowners now have a smarter alternative for tapping into their home equity.

Home equity has become a substantial portion of Canadian homeowners’ wealth (over $5 trillion!). Until now, there were only two ways to access that wealth: sell your home or take on debt. We thought there had to be an option for people who wanted to stay in the home they love and didn’t want to – or couldn’t – take on the burden of debt. So we created one: the HESA.

This announcement is a big milestone for us, launching our first product in our first market only 5 months after raising our pre-seed funding round. We also think it’s a big win for Canadian homeowners, who now have a true alternative to selling their homes and taking on debt to access their existing home equity.

There’s no restrictions on how Canadian homeowners can use a HESA to achieve their financial goals. Whether they want to supplement their retirement income, pay off debts, renovate their home, diversify their wealth, start a business, buy a property or anything else, a HESA is designed to provide financial flexibility to help achieve those dreams.

One question we get a lot is: if a HESA isn’t debt, what is it? A HESA is a financial contract. You can think of it a bit like an investment in your home equity. We help you tap into your home equity today (with cash) in exchange for sharing in some of the value of your home in the future (usually when you sell). There are no monthly payments for the entire term of your HESA.

Since you can sell anytime, you control the length of your HESA up to a maximum term of 25 years. That’s a long time – the Air Canada Centre Scotiabank Arena opened 25 years ago!

Whether you’re looking for $50,000 or $500,000, a HESA provides an alternative to traditional debt products like home equity lines of credit and reverse mortgages. We’re excited about the world of possibilities it can unlock for Canadian homeowners.

Introducing our new website

Today we’re also launching our new website with a number of resources to help homeowners.

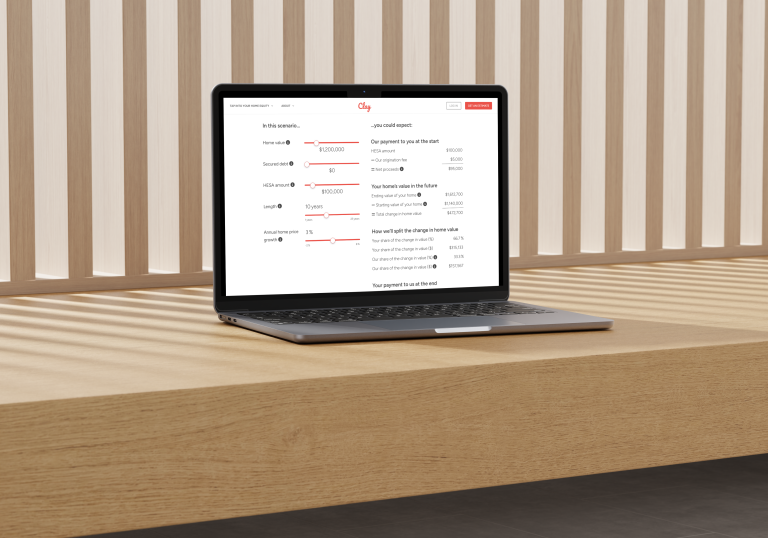

In addition to more information about our HESA, including what it is, how it works, who is eligible, what it costs and how to get one, we’ve rolled out an estimate tool and our HESA Dashboard.

Our estimate tool helps you understand how much equity you may be able to access with a HESA in under 2 minutes. Eligible homeowners are invited to create an account on our HESA Dashboard after receiving an estimate. And, if we don’t currently operate in your area, it gives you the option to join the waitlist with just a click.

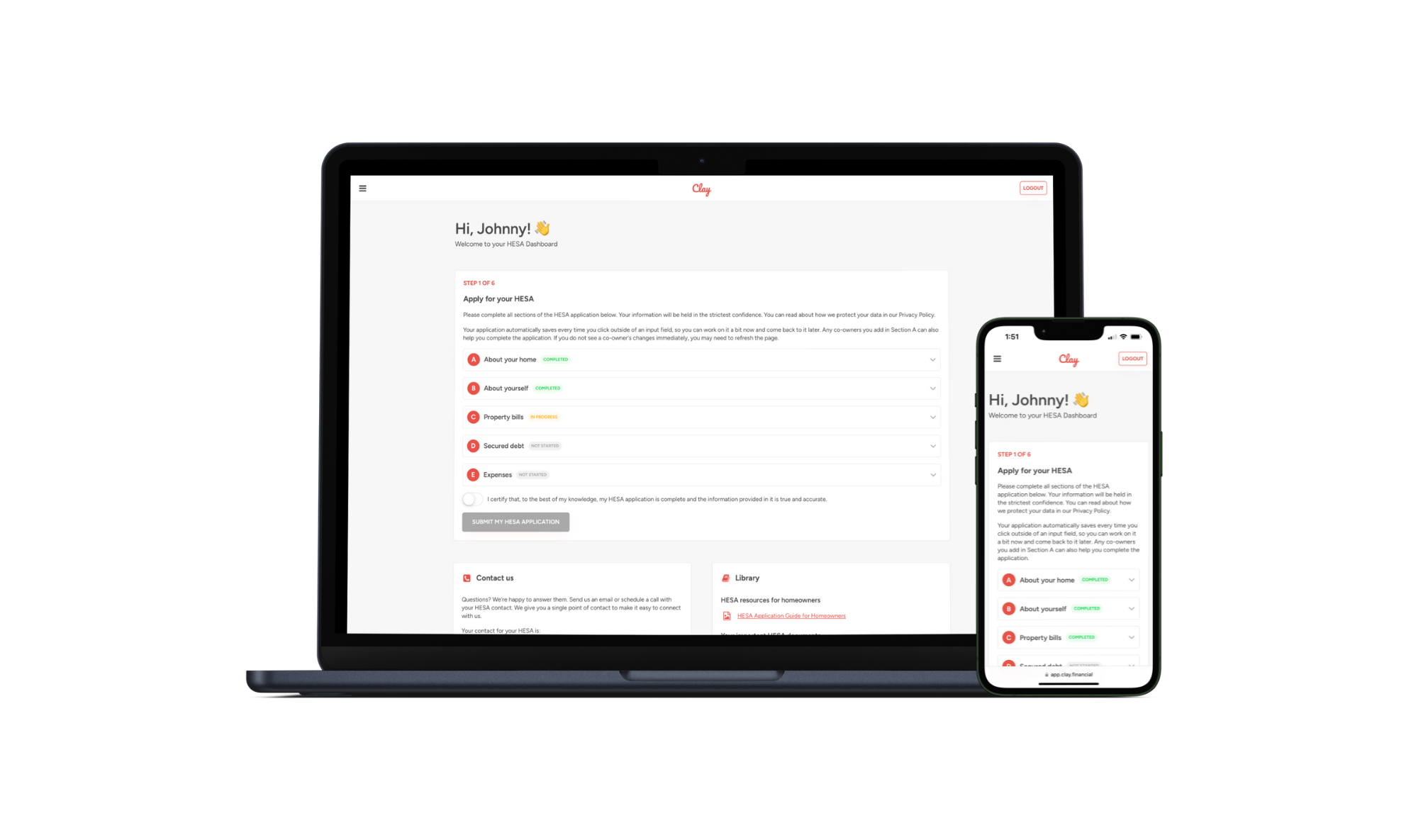

Our HESA Dashboard allows you to apply for a HESA, track every step of your application and manage your HESA online. It also provides you with access to helpful resources like our HESA Application Guide and the ability to instantly schedule a call with a member of our team. Built with security top of mind, our HESA Dashboard protects homeowners’ personal information with AES-256 encryption.

It’s easy to submit an application through our HESA Dashboard. We’re excited about all of the features available to homeowners, including real-time collaboration with co-owners, easy document upload using your smartphone’s camera and auto-save so you never lose your progress. We’ve also made it easy for homeowners to verify their identity anytime day or night from the comfort of home using some of the latest identity verification technologies.

We are Canadians’ new partner in home equity.